Tailored trading solutions by traders, for traders: seamless execution, strategy protection, and a competitive edge in a fast-evolving market.

We offer advanced and secure trading solutions

Built for Traders

Custom Algorithm

We tackle your market challenges

Struggling to find liquidity?

QwickRoute’s Liquidity Solution ensures seamless access across venues for minimal market impact and optimal pricing.

Demand quality & cost efficiency?

QwickRoute’s custom solutions and analytics help optimize execution, ensuring top results while controlling costs.

Worried about market info leakage?

Trade anonymously with QwickRoute. Choose venues, create competition, and execute quickly while protecting your strategies in a secure environment.

Navigating evolving regulations?

Stay compliant with QwickRoute’s customizable solutions, built to adapt to evolving regulations without compromising performance or quality.

Need a competitive edge in tech?

QwickRoute equips you with real-time analysis, cutting-edge strategies, and advanced analytics to keep you ahead of the curve in today’s fast-evolving trading landscape.

Success in trading requires deep market insights

At QwickRoute, our seasoned traders and expert developers bring unparalleled knowledge and practical expertise to our trading solutions, empowering you to execute any strategy with precision and confidence.

Enhanced Liquidity

Access a broad network of liquidity providers for minimal market impact.

Customized Workflows

Experienced traders and developers to provide customized trading solutions.

Data-Driven Insights

Utilize real-time analytics to make informed trading decisions.

Harness Liquidity & Command the Market

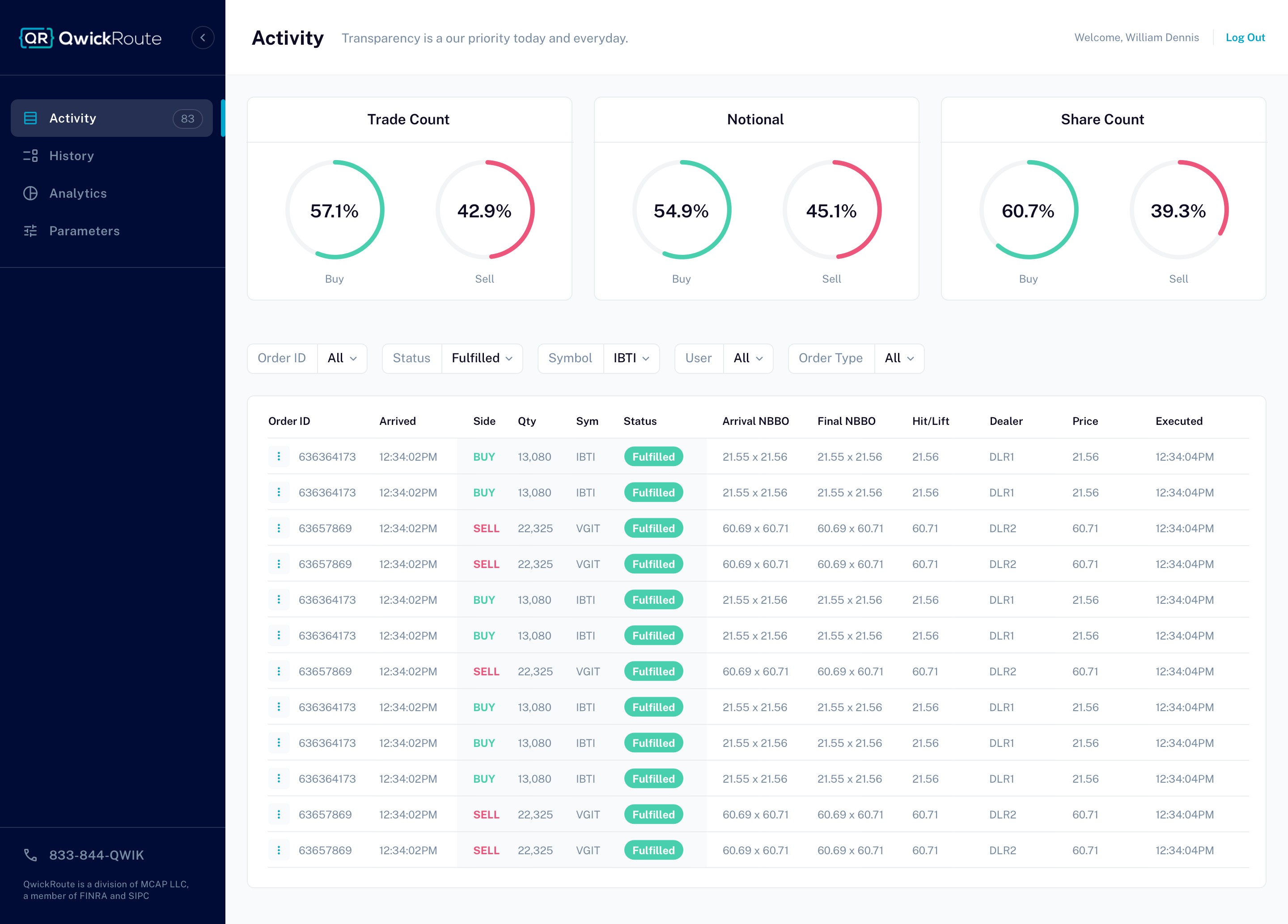

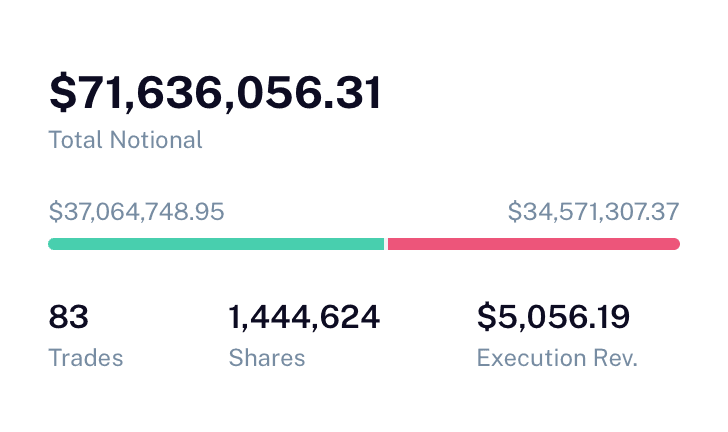

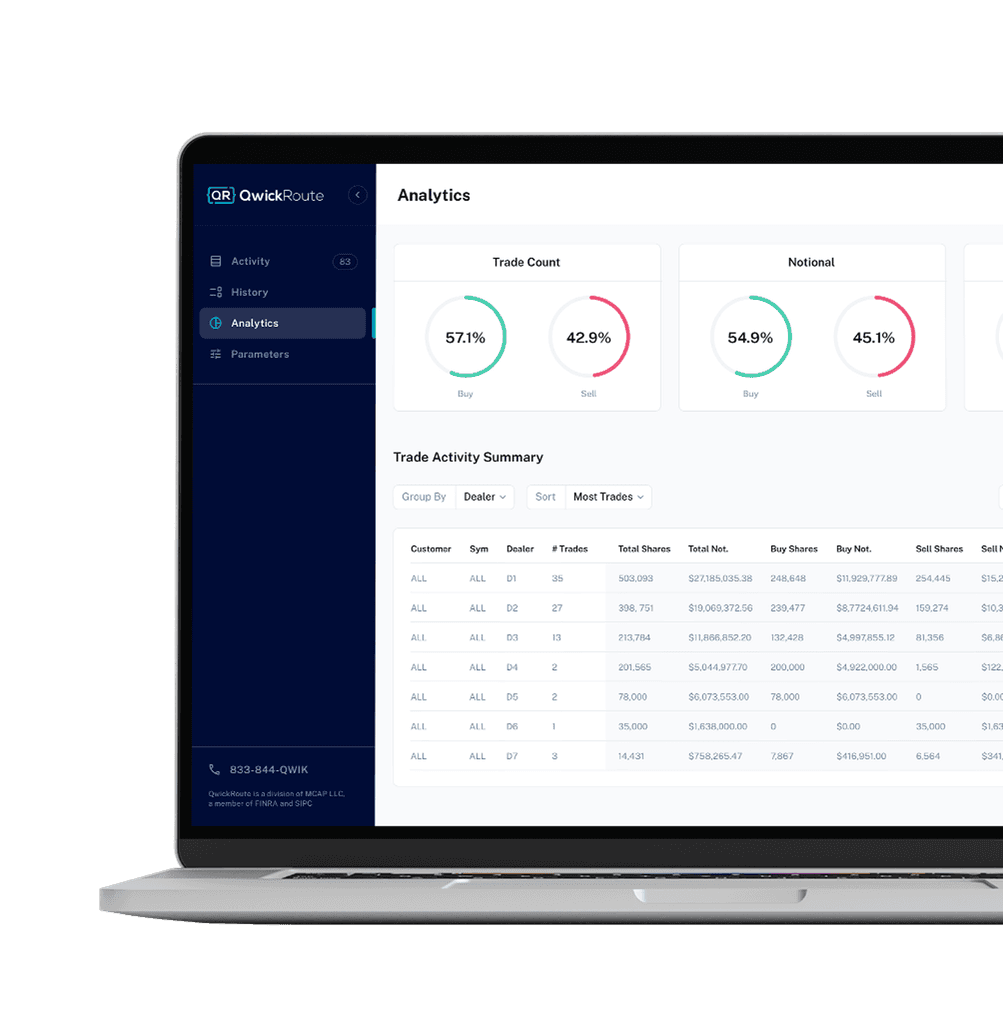

One platform to monitor & analyze your strategies

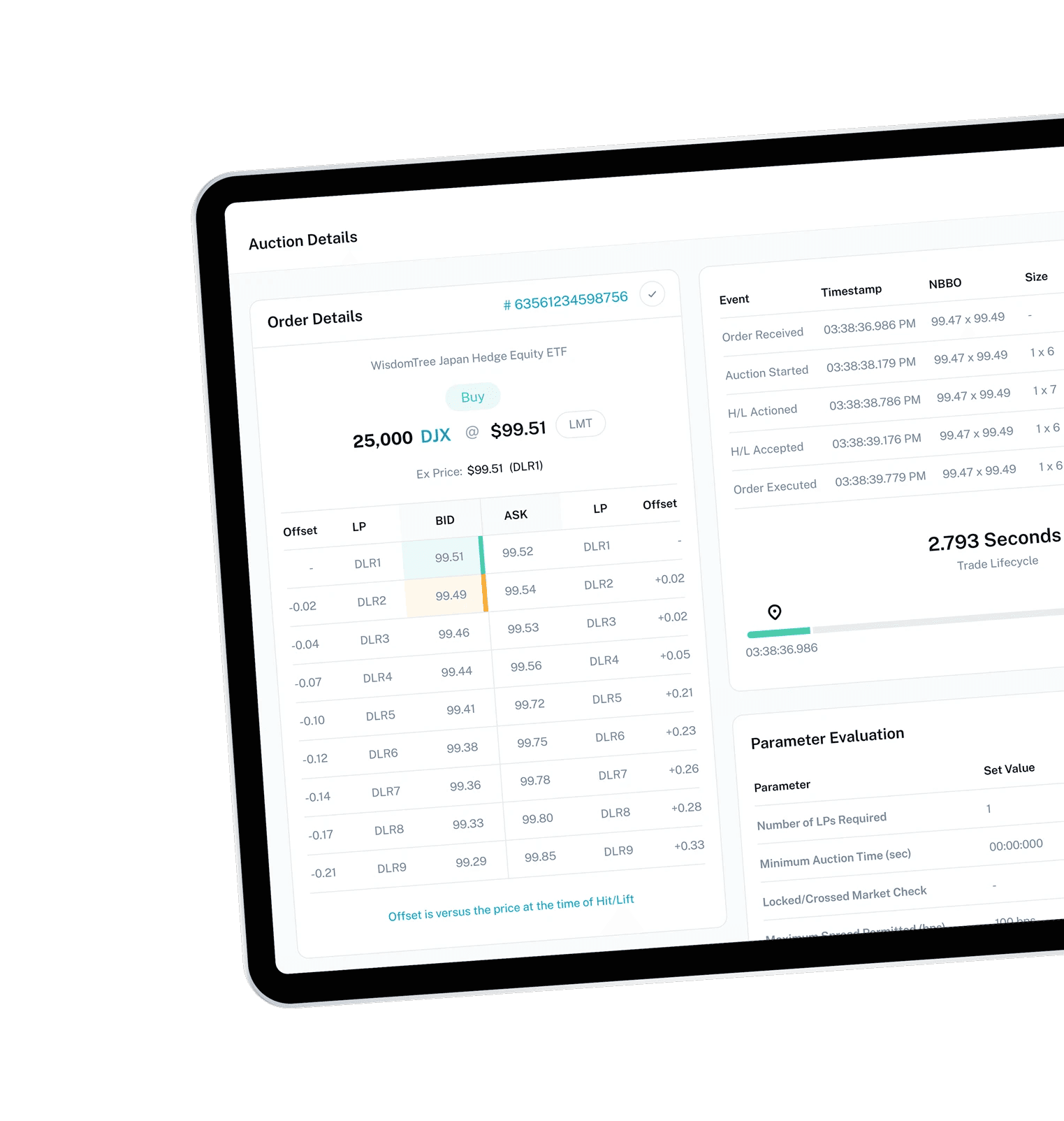

Transparency is cornerstone at QwickRoute. Our custom portal offers real-time insights into trading strategies, including blotter views, performance summaries, and customizable algorithm parameters. Analyze and compare algorithm performance historically and in real-time to achieve best execution.

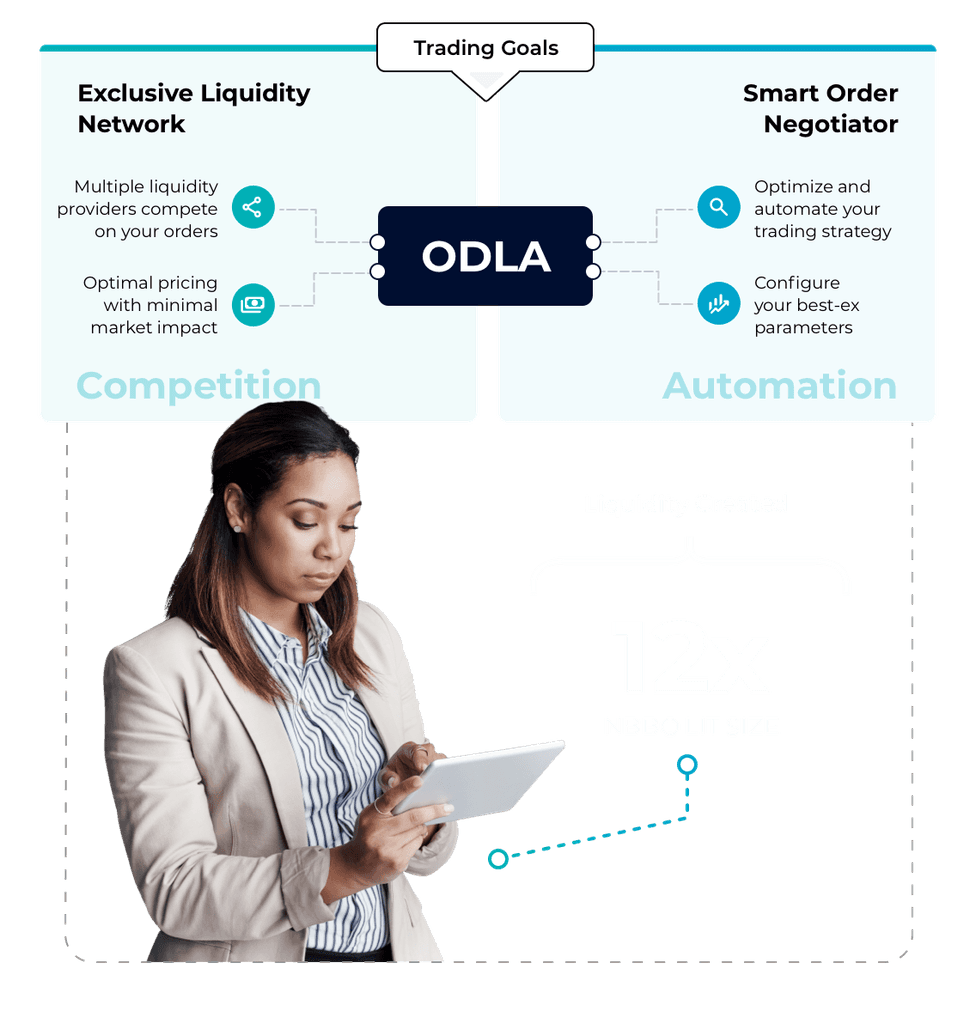

On-Demand Liquidity Auction™

Enjoy the flexibility and advanced capabilities of the ODLA platform. Trade anytime, anywhere with ease.

Liquidity Created

JWY

NBBO LIT SIZE

Average Auction

KXB

SECONDS

NBBO or Better

DBD

ORDERS EXECUTED

Discover responses to common asked questions about our product and services.

Need more assistance?

Ready to Powerfully Transform your Trading?

Explore QwickRoute’s advanced trading solutions and see how we can help you achieve your execution goals. Whether you want to improve liquidity access, protect your strategies, or navigate regulatory changes, QwickRoute is here to support you."